Revolution Proof of Stake — DeSo (The Decentralized Social Layer-1 Blockchain)

Proof of Stake — Without the Centralization • April 4, 2023

Authors: Nader Al-Naji, Isaac Anthony, Sofonias Assefa, Jackson Dean, Jason Mazursky, Piotr Nojszewski, Jonathan Pollock, Steven Zeller

Abstract

Revolution aims to be the first Proof of Stake protocol that is truly decentralized, censorship-resistant, permissionless, and easy-to-understand. In keeping with this, we strive to make this document comprehensive and straightforward to the point where anyone with basic Computer Science knowledge can read, understand, and implement the entire system from scratch.

Revolution enhances decentralization, censorship-resistance, and protocol complexity compared to earlier Proof of Stake schemes employed by Ethereum, Cosmos, Flow, and Solana. Compared to Proof of Work schemes like Bitcoin, Revolution offers better censorship-resistance due its introduction of the Revolution Rule concept, and maintains the same level of decentralization and protocol complexity without the need for wasteful computation, and without making any significant trade-offs.

Introduction

In this document, we present Revolution Proof of Stake (PoS), a new state-of-the-art Proof of Stake system designed to:

Eliminate centralization risks associated with other PoS protocols, especially those caused by liquid staking on protocols like Ethereum and Cosmos. This is achieved by two novel mechanisms we introduce called Sovereign Staking and Liquid Bonding. Our goal is for Revolution to finally make Proof of Stake systems as decentralized as Proof of Work systems like Bitcoin.

Eliminate censorship risks, making it so that a high-fee transaction is guaranteed to be included in a block within a few seconds of being submitted to the network under normal conditions. This is achieved by two new concepts we introduce called The Revolution Rule, from which the Revolution protocol derives its name, and a novel approach to leader scheduling we call Line of Succession Leader Scheduling.

Eliminate miner-extractable value issues (MEV), making it impossible for block producers to exploit users of the protocol. This is a second benefit of The Revolution Rule concept we introduce.

Scale to tens of thousands of nodes, without incurring quadratic communication overhead like other PoS schemes, including Ethereum. This is possible thanks to Revolution introducing the first production implementation of the Fast HotStuff consensus algorithm.

Remain fully permissionless, allowing anyone to join the network and produce blocks, just like Bitcoin. This is possible thanks to a combination of a novel randomness scheme we call Collaborand, as well as a novel bootstrapping scheme we call HyperSync Bootstrapping.

Eliminate developer oligarchy by introducing a novel and decentralized means of updating protocol-level parameters that we call On-Chain Amendments.

Maximize deflation by introducing a burn-maximizing fee algorithm that improves significantly on Ethereum's state-of-the-art EIP-1159. We call this fee algorithm The BMF, short for "burn-maximizing fees."

Minimize the cost of running a node by introducing a novel Dynamic Block Reward concept that adjusts the block reward to maximize both the amount staked as well as the number of validators, at minimum cost to the protocol.

Maximize simplicity of the protocol, making it understandable by anyone with basic knowledge of Computer Science, similar to Bitcoin's Proof of Work. Where other PoS schemes are riddled with convoluted jargon, making them difficult to follow and verify, Revolution prioritizes simplicity at the protocol level.

- We believe this is the most important thing that Bitcoin got right, with its simplicity allowing the mind-virus to spread, and we hope to bring that same simplicity and ease-of-understanding to Proof of Stake systems with Revolution.

Reduce finality time compared to state-of-the-art Proof of Stake systems, including Ethereum, Cosmos, Solana and Flow.

In order to achieve all of the above goals, Revolution introduces several innovations that we discuss in detail. Below is a summary of all of Revolution's more interesting contributions to the field:

Sovereign Staking (aka No-Lockup Staking). Most existing PoS mechanisms force users to lock up coins for long periods of time, often years, in order to stake. This not only causes centralization on "liquid staking" pools like Lido, but it also causes the protocol to be capital-inefficient in the sense that it now needs to pay validators much more via inflation to support the security of the network. In contrast, Revolution provides the same level of security as "long-lockup" mechanisms, but it only requires locking stake for roughly three hours (three Revolution epochs).

- Aside from significantly improving security and significantly reducing the amount that needs to be paid to validators as inflation, Sovereign Staking also reduces the regulatory risk associated with a protocol's token. This is because validators are paid solely for their work of validating blocks, rather than as a return on amount staked.

Production Fast-Hotstuff. The first production implementation of the Fast Hotstuff consensus algorithm. This allows Revolution to achieve the theoretically-optimal number of rounds of communication per block finalization, with a protocol that is both easy to understand and easy to debug.

Line of Succession Leader Scheduling. A novel leader selection scheme that significantly improves throughput and transaction finality time, without compromising on decentralization or censorship-resistance. This is achieved by allowing a single leader to remain the block producer until either their term expires (~1 hour) or they are caught provably censoring transactions.

The Revolution Rule. A novel mechanism that, when combined with Fast Hotstuff and Line of Succession Leader Scheduling, allows nodes to automatically timeout leaders that they believe to be censoring mempool transactions or extracting MEV. The end result is that transactions cannot be censored for more than a few seconds at most, even when leaders are acting maliciously.

Collaborand. A novel scheme for generating robust on-chain randomness, that innovates materially on all prior schemes. This is needed for any Proof of Stake consensus mechanism to function efficiently.

Elliptic Sum. A novel scheme for verifying that two nodes have the exact same state, without needing to store, index, and update a Mmerkle tree of every account. This cuts state storage costs in half, and increases the efficiency of modifying node state by an order of magnitude over previous state-of-the-art schemes.

Hypersync Bootstrapping. A permissionless way for a new node to join the network and efficiently download a potentially-sharded copy of the state, while being confident that its end-state is consistent with a majority of its peers.

On-Chain Amendments. A novel way of updating key PoS parameters via direct and safe on-chain voting. Whereas other protocols have "secret knobs" that an oligarchy of developers are in charge of updating behind the scenes, Revolution's introduction of on-chain amendments makes it so that all of Revolution's key parameters, including critical economic parameters like block rewards and yields, can now be modified with full transparency, and with full consent of the governed (namely the token-holders).

- This aspect of Revolution truly embodies the principle of "by the token-holders, for the token-holders," ensuring that the protocol maximally serves the interests of token-holders in the long run. This is more important than it seems because critical economic parameters like block rewards and yields will ultimately reflect the interests of token-holders rather than the interests of an oligarchy of developers.

The Burn-Maximizing Fee Algorithm (the BMF). A novel way of computing validator transaction fees that improves significantly on EIP1159, which is widely considered to be the state of the art. The BMF improves on EIP1159 especially during times of high-congestion, which is when fees are most lucrative to the protocol.

The Dynamic Block Reward (the DBR). A novel way of automatically adjusting validator block rewards to explicitly incentivize the total amount staked and the total number of validators on the network. Whereas other schemes dramatically over-pay validators for their services, the DBR ensures that validators are paid no more than their operating costs in the steady-state.

- Sovereign staking, the BMF, and the DBR all combine to create a far more deflationary protocol than has ever existed in the past. In particular, while sovereign staking and the DBR reduce emissions to the absolute minimum, the BMF maximizes the amount burned from transaction fees on the other side, thus making Revolution's deflation rate as close to optimum as possible.

Magic Nonces. A novel scheme for preventing transaction replay attacks that allows transactions to be re-ordered without needing to store a hash of every transaction that has ever been submitted to the network. Improves significantly on Ethereum's consecutive nonce scheme.

NetBoot. A novel way for a new node that joins the network to learn about all of its potential peers that is significantly more decentralized and more censorship-resistant than state-of-the-art DNS Bootstrapping employed by Bitcoin and Ethereum.

Liquid Bonding. (e.g. treasury.deso.com). Although Sovereign Staking means that nobody needs to lock up stake in order to secure the network, it is important to note that incentivizing people to lock up stake could be valuable for other reasons. As such, Revolution leaves blockchains the full freedom to design their lockup schemes however they want. This is achieved by introducing a separate and distinct YieldLock transaction type, which allows users to convert coins into bonds that earn a yield at a set maturity date.

- Importantly, Liquid Bonding allows users to lock up coins and earn a yield without introducing the centralization risks associated with liquid-staking providers like Lido. This is because users who decide to lock coins receive a liquid asset called a bond that is fungible with other bonds with the same maturity, but distinct from the protocol's main coin.

The separation of yield from protocol-level security allows node operators to collectively create arbitrarily-complex yield ladders that are not only much better at fulfilling the needs of the protocol, but that also fully separate any regulatory concerns from the security of the network. Also note that adding Liquid Bonding to a protocol is strictly optional in the sense that the network would be completely secure without it.

In what follows, we describe the Revolution PoS scheme in full detail while providing enough background that an audience that is only somewhat familiar with existing PoS schemes can understand it. For readers who are highly-literate and up-to-date on existing PoS schemes, the background section can be skipped.

Background on Proof of Stake Mechanisms

In this section, we do our best to get the reader up to speed on the existing state of the art when it comes to Proof of Stake. If the reader is already familiar with Proof of Stake schemes, such as Tendermint and HotStuff, this whole section can be skipped.

Starting with Proof of Work

To understand Proof of Stake, it is useful to understand the Proof of Work (PoW) consensus mechanism used by Bitcoin, and then work our way up from there.

When a user initiates a transaction on a Proof of Work blockchain like Bitcoin, it is broadcast to the network and added to a pool of unconfirmed transactions, often referred to as the mempool. Miners on the network then compete to validate and confirm these transactions by solving a complex mathematical puzzle through the proof of work algorithm.

Once a miner successfully solves the puzzle, they add a new block of transactions to the blockchain and broadcast it to the network. This new block contains a cryptographic hash of the previous block, which ensures that the blocks are linked together in a chain and cannot be tampered with or altered without effectively redoing all of the previous work that was done to solve the previous mathematical puzzles in the chain.

As more blocks are added to the chain, it becomes increasingly difficult to change any of the previous transactions, as doing so would require a significant amount of computational power to recalculate all the subsequent blocks in the chain. This creates a high degree of security and trust in the network, as transactions that have been confirmed by a sufficient number of blocks, usually taken to be six blocks for Bitcoin, are considered final and irreversible.

From Proof of Work to Proof of Stake (Tendermint)

At a high level, PoW chains can be considered to be holding an implicit vote among all of the miners on the network for each bundle of transactions, whereby each miner's vote is weighted by how much computational power they have. Each block, a delegate is selected to propose a block, where their likelihood of being selected is weighted by their mining power. In proposing a block, the miner not only casts their vote for the new bundle of transactions they're submitting to their peers, but they also cast their vote for all previous transactions in the chain submitted by other miners. As such, after enough blocks have mined on top of your transaction, you can be confident that a significant majority of the mining power has agreed to include it, thus finalizing it.

Proof of Stake schemes refer to their consensus nodes as validators rather than miners, and they generally consider the weight of a validator's voting power to be proportional to the number of coins staked, or delegated, to them rather than the amount of mining power they have. Additionally, most PoS schemes refer to block production in terms of views or slots. This is where the similarities between PoW schemes and PoS schemes start to diverge.

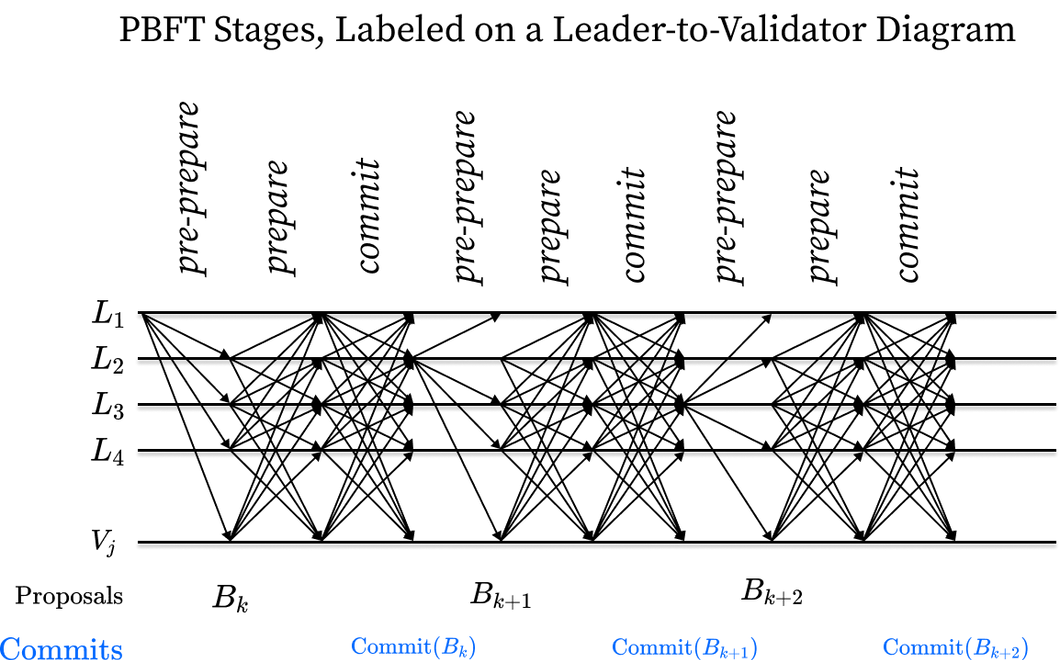

Unlike PoW schemes, PoS schemes attempt to finalize transactions by an explicit stake-weighted vote on each block via what's known as a two-phase commit scheme. The reason why this two-phase scheme works is complex, and discussed in full detail in Tendermint's paper here. However, it is lucky that the actual mechanism itself is relatively easy to explain at a high level, even though the proof is fairly involved. We explain a basic version of this two-phase commit scheme below, along with an intuitive explanation for why it works:

First, a leader is selected via a stake-weighted random sample of all validators. This leader bundles transactions into a block and sends this block to all other validators. This is often referred to as a pre-prepare message.

- Note that how the leader is selected is an important detail that differs significantly from Proof of Work. Whereas PoW leaders are selected based on their ability to find a winning block hash, PoS leaders are selected deterministically using some source of on-chain randomness. For now, all you need to know is that all validators know and agree on who will be the leader for view N.

After receiving a block, each validator first lets everyone know that they've seen the block and think it's valid by broadcasting a prepare message to all other validators.

- The messages between validators are often referred to simply as votes, as we will discuss later on.

In a second phase, each validator lets everyone know that they've seen that everyone has seen this block. This is done by broadcasting a commit message to all other validators only after they have seen a prepare message come in from a 2/3rds majority of all validators, weighted by stake.

- As an example, if there are five validators, and each validator has 100 coins staked to them, then a 2/3rds stake-weighted majority would be reached after receiving a prepare message from validators representing at least 2/3 * 500 total coins = ~333 coins, or four out of the five validators (representing 400 out of 500 coins, or a 4/5ths majority).

- The reason why a 2/3rds majority is used as the threshold for entering the second phase here is discussed in detail in Tendermint's proofs here. But again, it's OK to take it as a given for the purpose of understanding how the mechanism works.

- Put simply, once a validator has received a prepare message from a 2/3rds majority of all validators, they become confident that this 2/3rds majority has both seen the block and thinks it's valid.

Once a validator has received a commit message from 2/3rds of all validators, weighted by stake, they finalize the block, making it so that no message from any other validator will ever revert the block or the transactions within it.

Conceptually, a block is finalized when you are confident that everyone has both seen the block and confident that everyone has seen that everyone else has seen the block.

It is sufficient to understand that considering a block as finalized after you've seen that everyone else has seen it is safe in the sense that no two validators will ever commit conflicting blocks, and the block will never be reverted as long as 2/3rds of the validators, weighted by stake, are behaving honestly.

The above scheme is often referred to as a PBFT scheme, short for practical byzantine fault-tolerant, and it was refined in the Tendermint consensus protocol utilized by the Cosmos blockchain (here, byzantine can generally be considered synonymous with acting maliciously in order to try and compromise the network).

PoS schemes based on PBFT, like the one described above, are generally invulnerable to attack as long as at least 2/3rds of the validators, weighted by stake, are honest, or non-byzantine and non-faulty. This guarantee is analogous to the guarantee in PoW systems that the network will remain safe as long as a malicious entity does not control 51% of the hash power.

Importantly, each block in a PoS scheme like the above involves much more communication overhead than for a typical PoW scheme. Whereas a PoW scheme only requires each validator/miner to receive a block, a PoS scheme requires that each validator not only receives the block, but also that they receive multiple rounds of votes from every other validator on the network. In practice, this has not been an issue for modern Proof of Stake networks, but it is a difference that is worth noting.

Faulty Leaders and Timeouts

In the previous section, we considered a stake-weighted mechanism to come to consensus on which blocks are valid. But we only considered the happy path where all validators behave as they're supposed to. Unfortunately, this is not always the case, and so PoS protocols generally need to add a few extra provisions for cases in which leaders fail to produce blocks in time, among other scenarios.

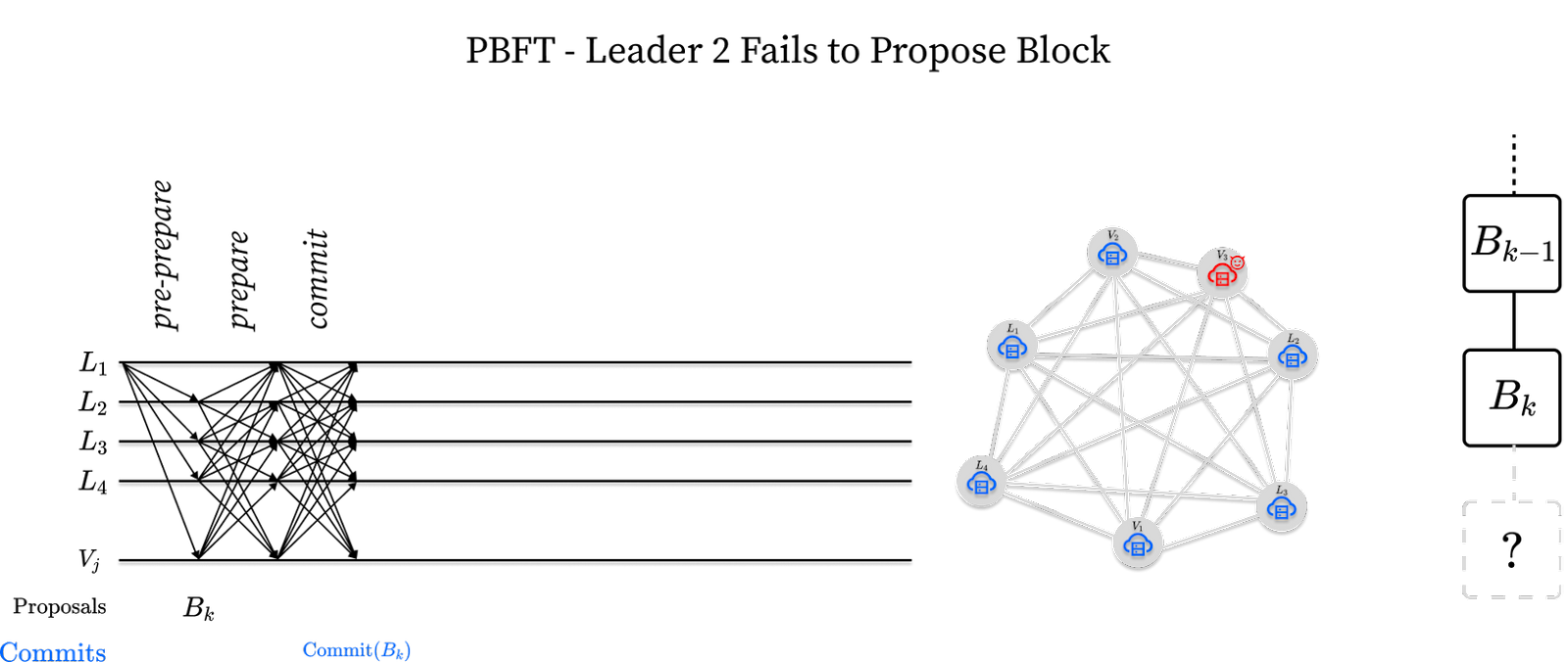

The two-phase core mentioned above ensures safety as it ensures no two validators will commit conflicting blocks at the same block height. However, consider the following situation where leader L2 is offline:

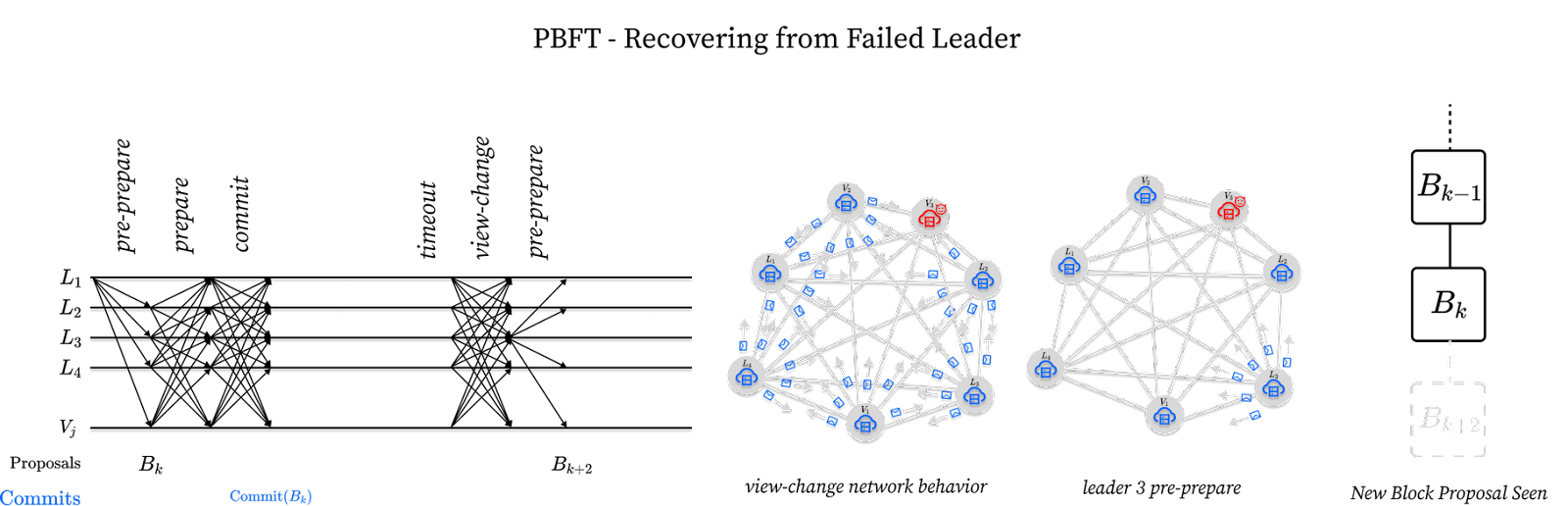

In this situation, leader L1 successfully commits a block Bk but leader L2 does not follow suit by proposing a block Bk+1. The network, if left alone, would permanently stall. The solution involves introducing a leader timeout. Validators are programmed to timeout after some time waiting for leader L2. When a timeout occurs a validator sends a view-change message to all validators in the network declaring their intent to move to the next leader. On receiving a 2/3rds stake-weighted majority of view-change messages, leader L3 can skip the previous round and propose a new block. This is depicted below:

While this represents a simple scenario where all validators timeout the same leader at the same time by sending a view-change message to L3, in theory the timeout scenarios can be much more complicated, hence why the proofs of PBFT protocols can get fairly involved.

To illustrate this complexity, consider an extreme situation where half the validators signal a timeout, i.e. a view-change, to leader L2 while half the validators receive a valid block from L2 and signal a timeout, i.e. a view-change, to leader L4. While this seems like an extreme example, it could reasonably happen if a malicious leader were to intentionally partition the network by only sending their block to half of all validators, or if the network were to experience extreme issues, such as an internet outage. In these situations, leaders L3 and L4 would never be able to commit a block, as half the network expects the next block from leader L3 and half the network expects the next block from leader L4, and a 2/3rds majority is required to make forward progress. As such, every validator would timeout and the network would transition to half the leaders expecting a block from leader L4 and the other half expecting a block from leader L5. The way we've described the timeout mechanism above, without intervention, the network would never converge on a new leader and the network would effectively halt, or lose liveness.

To prevent this issue, PoS consensus protocols with round-by-round leader schedules require exponential backoff in their timeouts following the last committed block. Without going into too much detail, it is sufficient to understand that effectively doubling the timeout each time a node sends a view-change message results in the two partitions of the network eventually catching up to each other, rather than stalling indefinitely (proof available in Tendermint's paper here).

From Tendermint to HotStuff

The mechanism described previously gives a good foundational understanding of how a PoS consensus protocol can produce blocks. But it has two core issues that a new mechanism called HotStuff improves upon that we walk through below.

O(n2) -> O(n) Communication Overhead

First, in order for a block to be finalized in a PoS scheme like Tendermint, messages must be sent from each peer to every other peer. It would be much better if a single node could be assigned to aggregate these messages for each round, thus reducing the communication overhead from O(n2) to O(n).

We can achieve this by requiring that all pre-commit and commit messages are sent to every other validator, but rather only to the leader. This allows the leader to act as an aggregator of messages, thus reducing the communication overhead from O(n2) to O(n). The modified scheme looks as follows:

First, a leader is selected via a stake-weighted random sample of all validators. This leader bundles transactions into a block and sends this block to all other validators via a pre-prepare message like before.

After receiving a block, each validator sends their prepare message directly back to the leader rather than to every other validator.

The leader aggregates all of the prepare messages until they have received them from a 2/3rds of all validators, weighted by stake.

Once the leader has aggregated a sufficient number of prepare messages from validators, they send this aggregated bundle of messages to every validator.

- Depending on how this is implemented, the communication overhead of what the leader sends to all validators may technically still be O(n2), since the leader's message will contain O(n) prepare messages from validators. This can be reduced using a concept known as a threshold signature, which results in only O(1) information being communicated back per validator.

After receiving the bundled prepare messages from the leader, each validator sends their commit message directly back to the leader rather than to every other validator.

The leader aggregates all of the commit messages until they have received them from a 2/3rds of all validators, weighted by stake.

Once the leader has aggregated a sufficient number of commit messages from validators, they send this aggregated bundle of messages to every validator.

After receiving a bundled commit message from the leader, they finalize the block, making it so that no message from any other validator will ever revert the block or the transactions within it.

In practice, the above scheme achieves much better performance because the leader bundles validator messages together, rather than requiring each validator to send messages directly to every other validator.

Block Pipelining

Even with the above optimization, it is still the case that three rounds of communication are required to finalize each block, and that the finalization of the next block cannot proceed until these three rounds occur.

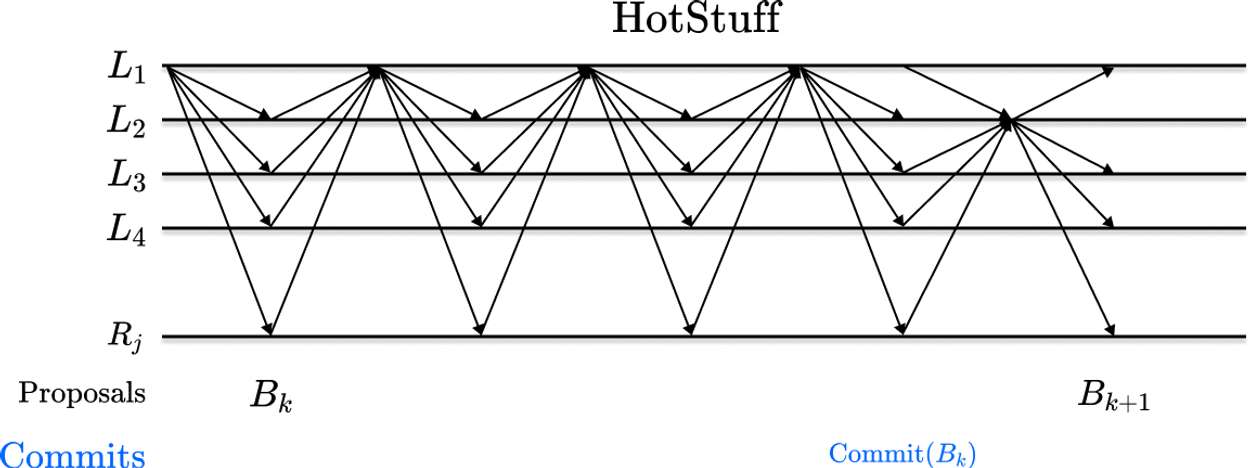

A natural optimization is to pipeline block finalization so that the round of voting on each block implicitly finalizes previous blocks. This not only results in a 3x reduction in the overhead required to finalize each block, but it also results in a conceptually simpler-to-describe mechanism that works as follows:

First, a leader is selected via a stake-weighted random sample of all validators. This leader bundles transactions into a block and sends this block to all other validators via a simple block-proposal message.

After receiving a block, each validator sends a simple vote message back to the leader, indicating that the block is valid.

- Importantly, the vote message replaces both the pre-commit and commit messages from the previous schemes.

The leader aggregates all of the vote messages until they have received them from a 2/3rds of all validators, weighted by stake.

Once the votes are aggregated, the leader forwards the votes in a bundle to the next leader. This bundle of votes is usually referred to as a Quorum Certificate, or QC for short, and it simply refers to the votes from 2/3rds of validators.

Once the next leader receives the QC from the previous leader, they propose the next block, and include the QC from the previous block within it.

A validator considers a block Bk-3 as finalized when it receives a QC for block Bk.

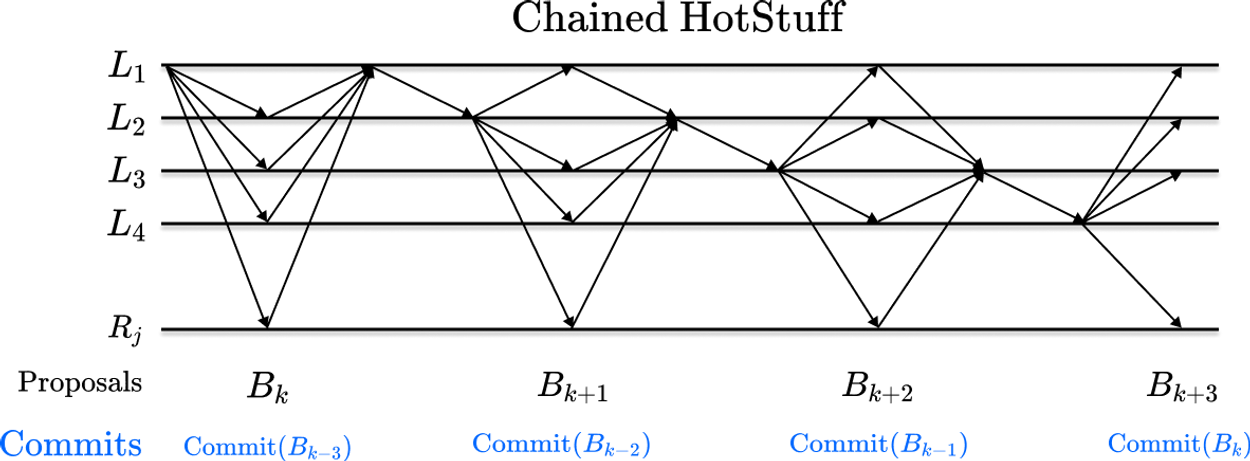

- Notice there is no fundamental difference between the commit rule for Chained HotStuff and the commit rule for Tendermint. Both still rely fundamentally on the concept of verifying that everyone has seen that everyone has seen a block. Chained HotStuff is just more efficient in its messages because it uses messages that indicate that a validator has seen block Bk to also indicate that the validator has seen that everyone has seen block Bk-1.

Chained HotStuff makes it so that every round of communication results in a finalized block, thus resulting in a 3x reduction in overhead required to commit each block.

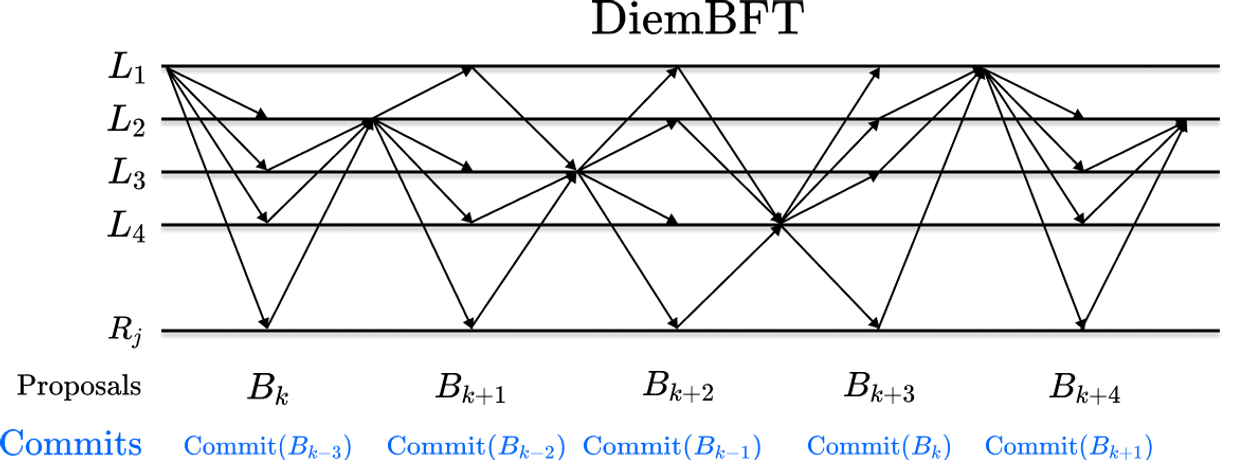

To reach even higher throughput, Novi, a subsidiary of Facebook, introduced DiemBFT, which provided a simple optimization whereby validators send their votes directly to the next leader instead of sending them back to the block proposer.

While a minor improvement, such a scheme leads to higher throughput and lower latency for the network. Below is the communication footprint for DiemBFT. Notice the deliberate and structured communication pattern between validators and leaders. The assumption is that validators are in sync as to who will be the next leader and are capable of coordinating their messages as such.

Importantly, because DiemBFT introduces significant complexity over alternative schemes, without much benefit over simpler schemes, we will not be considering it for our implementation. However, it is useful to consider a diagram of what it looks like below, and to compare to Chained HotStuff from above:

Reducing One More Round with Fast HotStuff

Looking at Chained HotStuff, the commit rule indicates that a validator will finalize block Bk-3 when it receives block Bk. However, with a slight modification, we can reduce one more round of communication, such that a validator can effectively finalize block Bk-2 when it receives Bk. Moreover, we can do this without a significant increase in complexity.

Revolution achieves this by implementing an optimized state-of-the-art version of HotStuff called Fast HotStuff, which we describe in detail later on when we describe the Revolution consensus mechanism in detail.

Revolution Proof of Stake

Revolution combines several state-of-the-art innovations, listed in the introduction for reference, into one easy-to-understand and straightforward Proof of Stake protocol. In what follows, we explain all of the components of Revolution, effectively building up the protocol fully from scratch for a lay reader.

We start with how a new node syncs from its peers when it first joins the network, and then build up to how leaders are selected and blocks are produced and finalized in the steady-state. As we go along, we also cover other novel details like Revolution's burn-maximizing fee mechanism and its dynamic block reward scheme.

The Lifecycle of a Node

To fully understand Revolution and why it's important, it's important to understand the lifecycle of a node on the network.

Download and run the node software. First, one downloads the node software from the relevant repository and runs it.

- In the case of DeSo, one can either run a Rosetta node, as exchanges like Coinbase do, or a full node, as apps like Diamond and Openfund do.

- It is also important to mention that many apps like the DeSo Wallet app and the DeSo Chat Protocol demo app do not run their own node, but rather use the web2 APIs exposed by pre-existing nodes such as node.deso.org, which makes it much easier to build great user experiences.

Find other nodes to connect to (DNS Bootstrapping). Once the node software is running, the first thing it needs to do is find other nodes to connect to that it can sync from. This is done via a process called DNS Bootstrapping, which we discuss in detail in a subsequent section.

Download the current state from peers (HyperSync Bootstrapping). Once the node has found a set of valid peers to connect to, it needs to get its state up-to-date with that of its peers.

Put simply, every node on the network needs to have a consistent view of all account balances and, in the case of DeSo, all content as well such as posts, follows, NFTs, etc...

The DeSo blockchain has an extremely efficient syncing method known as Hypersync Bootstrapping, which we will discuss in detail in a subsequent section. Simply put, Hypersync allows a node to first download a snapshot of the existing state from its peers, i.e. all balances and content, then sync blocks up to the tip thereafter. This is much faster than having to sync all blocks from the beginning of time, like many other protocols do.

Become a validator - optional. Once a node is fully up-to-date with all of its peers, it can either passively receive transactions (via blocks) and commit them to its state to stay up-to-date, or it can become an active participant in consensus called a validator. The process of becoming a validator will be described in detail in subsequent sections, but a preview is below.

In order to become a validator, a node must first register itself with the network by submitting a transaction containing a public key, which will be used to identify it as a validator.

Once a node has registered itself as a validator, anyone can stake coins to this node, allowing it to have more weight as a participant in the network. We will go into all the details of this in subsequent sections.

Participate in consensus - optional (Fast Hotstuff). Once a node has become a validator, with some stake assigned to it, it can now participate in the process of bundling transactions into blocks and voting on blocks, causing the transactions within them to be committed to the state of all nodes on the network.

- Revolution relies on a particular consensus algorithm to achieve this called Fast Hotstuff, and we will discuss how the process of proposing and finalizing blocks works in subsequent sections.

Of course, Revolution adds various twists to this process when compared to other protocols, such as introducing the concept of revolt among nodes on the network, and introducing a burn-maximizing fee model, among other innovations.

The above being said, this basic context is really all a node on the network will be doing at the high level. The rest of this document will just focus on the details of each step, starting with finding peers and working our way up.

Netboot: Censorship-Resistant DNS Bootstrapping

The first step when a node comes online is to find peers that it can connect to. But this is a trickier problem than it sounds. After all, if you've just downloaded the software for your node and run it for the first time, then you won't know who's online for you to connect to. The situation is not dissimilar to moving to a new town where you have no pre-existing relationships.

Hardcoding bootstrap peers: The most obvious way is to hardcode a list of peers into the software that node operators download. The problem with this is that updating the list of peers requires a centralized decision to be made by the development team, and then also requires everyone to download the latest copy of the software, which is very cumbersome.

Naive DNS bootstrapping: The way that software like Bitcoin solves the problem of hardcoded peers is that the software hardcodes a list of domains, such as seed.bitcoin.sipa.be. This allows the list of bootstrap peers to be updated without needing a centralized decision to be made by the developers and without needing everyone to update their software. Instead, you just need one of the owners of a trusted DNS bootstrap domain to update their DNS records to add a new peer. Once this is done, everyone who runs the software will query this peer when they first boot up.

- You can actually see the list of DNS bootstrap domains for Bitcoin Core in their GitHub repo here. Cool right?

The problem with the naive DNS bootstrapping approach is that it's still highly-centralized because you need the operator of one of the trusted DNS bootstrapping domains to make a decision in order for the bootstrap list to be updated. Wouldn't it be nice if anyone could add themselves to the list of bootstrap peers at any time? This is what we solve with a new DNS bootstrapping approach we call Netboot.

Netboot censorship-resistant DNS bootstrapping: With Netboot, instead of relying on a fixed set of hard-coded DNS bootstrapping domains, nodes are programmed to scan a wide field of domains based on a prefix. We explain this with an example below.

Consider an example where a node is hard-coded with the Netboot prefix revolution-seed-[0-9]*.io. A node implementing the Netboot approach would begin scanning every domain that satisfies the prefix, starting with revolution-seed-0000000.io and finally finishing at revolution-seed-9999999.io. It then would treat each domain as a DNS bootstrapping domain. The advantage of this approach is that anyone can buy a domain that satisfies this pattern and be added to the set of bootstrapping domains without needing approval from a centralized set of people.

As long as the space of domains is sufficiently large, it would be prohibitively expensive for one entity to purchase all of the domains in the space. Moreover, as long as a single valid domain exists in the set of domains being scanned, the node will eventually find a valid peer to begin syncing from, and it can move on to the next phase of bootstrapping.

HyperSync: Efficient Snapshot Bootstrapping

Once a node has found a valid peer to sync from, it moves on to the next phase of bootstrapping: HyperSync. In this phase, the node downloads a snapshot of the current state from one of its peers and verifies that this snapshot is consistent with what it is seeing from other peers via a novel checksum algorithm we call Elliptic Sum, which we'll explain in this section.

Before we go into explaining HyperSync, it's useful to first understand how more traditional blockchains like Bitcoin get up to speed. In Bitcoin, new nodes must download and verify the full history of transactions since the very first block in order to be able to process transactions and participate in the consensus process. This can take a long time, and is a major bottleneck for new nodes joining the network.

In contrast, HyperSync allows new nodes to get up to speed much faster. This is because instead of downloading the full history of transactions, nodes only need to download the latest snapshot of the network state, and then transactions from the snapshot block height to the tip of the blockchain (i.e. the most recent block that has been broadcast to the network).

The snapshot contains the current state of the ledger (including all balances and content), and the current validator set. With this information, the node can quickly verify the integrity of the current state of the network and start participating in consensus without having to download and verify all transactions from the beginning of time.

Elliptic Sum

One major key to HyperSync's performance is the Elliptic Sum checksum which DeSo describes in its full implementation details here. Elliptic Sum is a checksum generated by each node which verifies the consistency of the snapshot across multiple peers.

Simply put, if two nodes have exactly the same snapshot state, then the Elliptic Sum value for each of them will match. Otherwise, if even a single byte of their snapshot state differs, then they will have a different value for their Elliptic Sum.

When a node downloads a snapshot from a peer, it calculates the Elliptic Sum checksum for that snapshot. It then compares the checksum to the checksums calculated by other peers. If the checksums are all the same, the node knows that the snapshot is consistent across peers and can trust that it is up-to-date. This allows it to start participating in consensus without needing to download the full history of the blockchain.

Performing an integrity-check like this is critical, as without it a nefarious node could trivially sneak a malicious balance into its state with millions of coins in it. This would be especially costly if your node is powering an exchange like Coinbase.

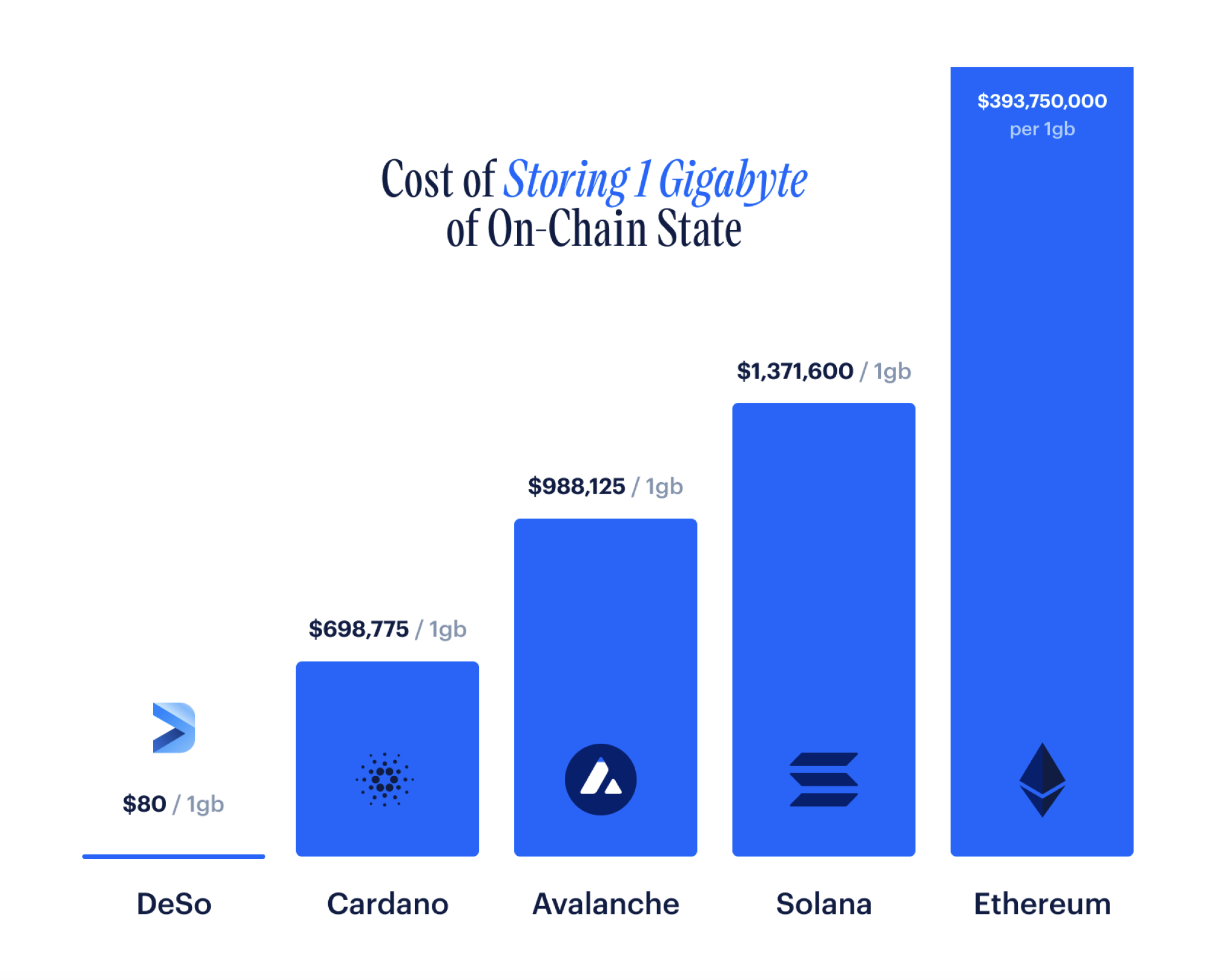

The main breakthrough that Elliptic Sum introduces over other approaches is its speed and its space-efficiency. In particular, while other protocols like Ethereum and Solana support a "fast sync" option, the integrity-check portion of their sync requires them to compute a merkle tree of all values in their state (a good explainer of merkle trees here).

Merkle trees not only double the storage requirements of a node, but they also result in every state change requiring many random hops through disk to modify the merkle tree up to its root. For this reason, Solana and Ethereum are both notoriously slow at processing state changes, and have extremely high storage requirements for full node operators.

In contrast, DeSo nodes, which implement Elliptic Sum, incur only a 32-byte overhead for their integrity-check, and updating the checksum is done in constant-time, with no disk-hopping. This constant-time update combines with Ancestral Records, which we'll discuss in the next section, to produce truly breakthrough node efficiency, especially from a content storage standpoint.

Ancestral Records

Concretely, nodes produce and store snapshots at known intervals, say one snapshot every week. These intervals are expressed in a number of blocks, so if Revolution produces a block every 3 seconds, then nodes would produce a snapshot roughly every 201,600 blocks (1 week expressed in a number of blocks). This snapshot interval would be common across nodes so that checksums for known block heights can be easily compared.

The naive way to produce a snapshot would be to simply store a full copy of the entire state at each interval. While this would be incredibly costly from a space-efficiency and computation standpoint, and arguably prohibitive for chains that intend to store a significant amount of content, most protocols actually do something naive like this to support their "fast sync" approaches.

In contrast, HyperSync utilizes a very clever scheme called Ancestral Records, described in detail here, which allows it to only store the changes between the snapshot height and the tip.

In particular, every time the state is modified after a snapshot, the old record is stored so that it can be used to recompute the snapshot from the "tip" state at will. At any block height after the snapshot, the full snapshot state can be derived by taking the current state at the tip and effectively merging it with the ancestral records. Then, once the node reaches a new snapshot interval, it just needs to delete all of its ancestral records and start creating deltas from the new snapshot height.

This results in a radical improvement in space-efficiency when compared to other approaches to node snapshotting.

Putting it All Together

Elliptic Sum's constant-time constant-space checksum scheme combines with Ancestral Records to produce a truly breakthrough snapshotting scheme from a storage-efficiency standpoint. In particular, because Elliptic Sum's update is constant-time and constant-space, it is virtually free to keep and update a checksum for each state snapshot. In particular, every time a value in the state is modified, both the snapshot checksum and the tip checksum can be modified in constant-time, and incur an overhead of only 32 bytes each.

The inefficiency of alternative schemes for producing new snapshots at regular intervals, and keeping their checksums up-to-date, presents a natural ceiling on how much data a blockchain can reliably store. For example, if a node is naively making a full copy of the state every time it produces a snapshot, or even if it's modifying cumbersome merkle trees on every write, then it effectively needs to be able to pause all on-chain activity for the amount of time that it takes to do those operations. Such a scheme would naturally not be able to manage an amount of content from a social graph the size of Instagram or Twitter, as the full copy would take a prohibitive amount of time, potentially days, and hopping around disk on every write to compute a checksum would likely become prohibitively expensive (and potentially require cross-machine communication for every single write).

As such, partially as a result of Elliptic Sum's breakthrough space-efficiency gains over merkle trees, and Ancestral Records' breakthrough space-efficiency gains over naive full-copy snapshotting, the DeSo blockchain is capable of storing one gigabyte of data for about $80, while Solana costs about $1.3 million for the same amount of storage, and Ethereum costs about $393.7 million (calculations here). We believe this is due to the fact that the natural ceiling for what DeSo is capable of storing is significantly higher.

In summary, HyperSync is a novel way of bootstrapping a node quickly and securely, allowing new nodes to join a blockchain network and start participating in consensus much faster than they could with traditional blockchains.

For a deep-dive on how HyperSync, Elliptic Sum, and Ancestral Records work, check out DeSo's full description of its implementation here.

Sovereign Staking (a.k.a. No-Lockup Staking)

Once a node is fully in-sync with its peers, it can automatically begin to receive blocks, check their validity, and commit them if it finds them to be valid. However, in addition to passively receiving blocks, a node can also become an active member of consensus by becoming a validator. We describe what that looks like in this section.

Registering as a Validator

DeSo’s Proof of Stake protocol is permissionless, meaning any user can register as a validator to help secure the network at any time. To register, a user submits a transaction to the network telling other nodes that they want to participate in consensus. When a user submits a RegisterAsValidator transaction, they provide roughly the following information:

- Their public key

- An ordered list of domains where their node(s) can be reached for sending and receiving protocol-related messages

- A flag indicating whether or not they will accept delegated stake, i.e. stake assigned to them by other users

Once this transaction has been validated and accepted by the network, the node is now a registered validator and stake can be added either directly by the user (self stake) or, if allowed, by other users (delegated stake).

If the user decides to remove themselves from the validator set, they can submit an UnregisterAsValidator transaction to the network. This will automatically return all of the validator’s stake to each staker and remove the validator’s eligibility to participate in consensus.

A benefit of a decentralized network is that there is no single validator who is a single point of failure. If a validator unregisters, the network continues to produce blocks as before with zero downtime.

As a safety check, Revolution requires a cooldown period of approximately three hours (three epochs, as we'll discuss) between a validator registering and unregistering to prevent users from trying to flash-stake or arbitrage some leader schedule opportunity by quickly registering, staking, and unregistering. Revolution also implements additional safety mechanisms against this via an unstaking lockup as well, explained in the Unstaking section below.

Staking

Any user can provide stake to an existing validator, either to their own node or, if allowed by the validator, to a third-party validator who accepts delegated stake. To stake coins with a validator, a user submits a “Stake” transaction to the network specifying roughly the following values:

- The staker's public key

- The public key of the validator they want to stake to

- The number of coins they would like to stake

The coins are removed from the user’s wallet and held in escrow while staked with the validator. Importantly, the validator never takes custody of any delegated stake, so it is impossible for a malicious validator to run away with any delegated stake. This means that any staked funds are secure and not reliant on any trust with the validator. Staked coins are never accessible to the validator, instead they are only accessible to the staker directly and only if unstaked and unlocked.

The user can increase their stake position either with that validator or with any other eligible validator by simply submitting another Stake transaction. A user can stake up to 100% of the coins held in their wallet (net any transaction fees required to retrieve their funds). Staking is an easy and secure way to passively receive a reward for securing the network, as discussed in the next section.

Block Rewards

Any registered validator with non-zero stake is eligible for block rewards. Refer to the Dynamic Block Rewards section for more information on how block reward amounts are determined. The recipient of the block reward is randomly chosen (weighted by stake) using Collaborand, Revolution's on-chain randomness generator, as the seed for the random sample. In this way, the block rewards a validator can expect are proportional to the amount staked with them. The leader also receives a small percentage block reward to incentivize their responsibilities to construct and broadcast satisfactory blocks as well as compile other validator votes approving the block.

By design, Revolution does not include any slashing mechanism, and it does not require any stake to be locked up for long periods of time, as will be discussed in the Unstaking section. This is a major advantage for validators who are concerned about intermittent downtime putting their stake at risk, as is the case with other protocols. Instead, leaders who fail to propose a block and/or validators who fail to vote on a block are simply not eligible for block rewards. This incentivizes all leaders and validators to follow the rules of the protocol if they want to receive block rewards, while not placing their original stake at risk. If a malicious leader chooses to delay submitting a block, they will timeout, lose out on potential block rewards, and the protocol will continue unabated with the next leader in the leader schedule. If a malicious validator refuses to vote on blocks, they will similarly be ineligible for any block rewards.

With each block that gets accepted by the network, a block reward is assigned to a random validator. The protocol does not enforce the mechanism by which validators subsequently split up block rewards to be distributed among their delegated stakers. This gives validators an axis of competition across which they can compete for delegated stakers, attracting new stakers by minimizing their fee for operating a node and maximizing the block reward percentage flowing back to the stakers. Stakers will then be able to choose a validator comparing their relative fees in the Validator Hub (see section below). Stakers can have their block rewards automatically restaked, by issuing a derived key to the validator granting the validator permission to issue Stake transactions on their behalf. This is a major advantage over other protocols which require block rewards to be manually claimed by stakers and manually restaked on some cadence.

Unstaking

A user with staked coins can unstake up to 100% of their stake with any validator by submitting an Unstake transaction to the network specifying roughly the following information:

- The staker's public key

- The validator’s public key

- The amount to be unstaked

Unstaking immediately removes the specified stake from the validator and will immediately impact stake-dependent calculations for the validator such as their chances of receiving a block reward and their placement in future leader schedules. The funds will not, however, be immediately available for withdrawal by the user. There is a brief lock-up period (lasting two epochs, or two hours, as we will discuss in a later section) during which the funds are held in escrow, neither staked with the validator nor accessible by the user. Once the brief lock-up period has passed, the user can submit a second UnlockStake transaction to the network whereby their funds will be returned automatically to their wallet.

The purpose of this lock-up period is to prevent leader schedules from becoming gameable by malicious stakers quickly adding and removing stake. As explained in more detail in our Line of Succession Leader Scheduling section below, leader schedules are determined two epochs in advance and unstaked funds are locked for two epochs. This ensures that there cannot be any flash-staking operations to try to manipulate the leader schedules. The leader schedule is guaranteed to reflect all stake currently assigned to each leader during the epoch in which that leader schedule is in effect. A user can submit multiple Unstake transactions to unstake incremental funds from the validator, or funds from multiple different validators.

Validator Hub

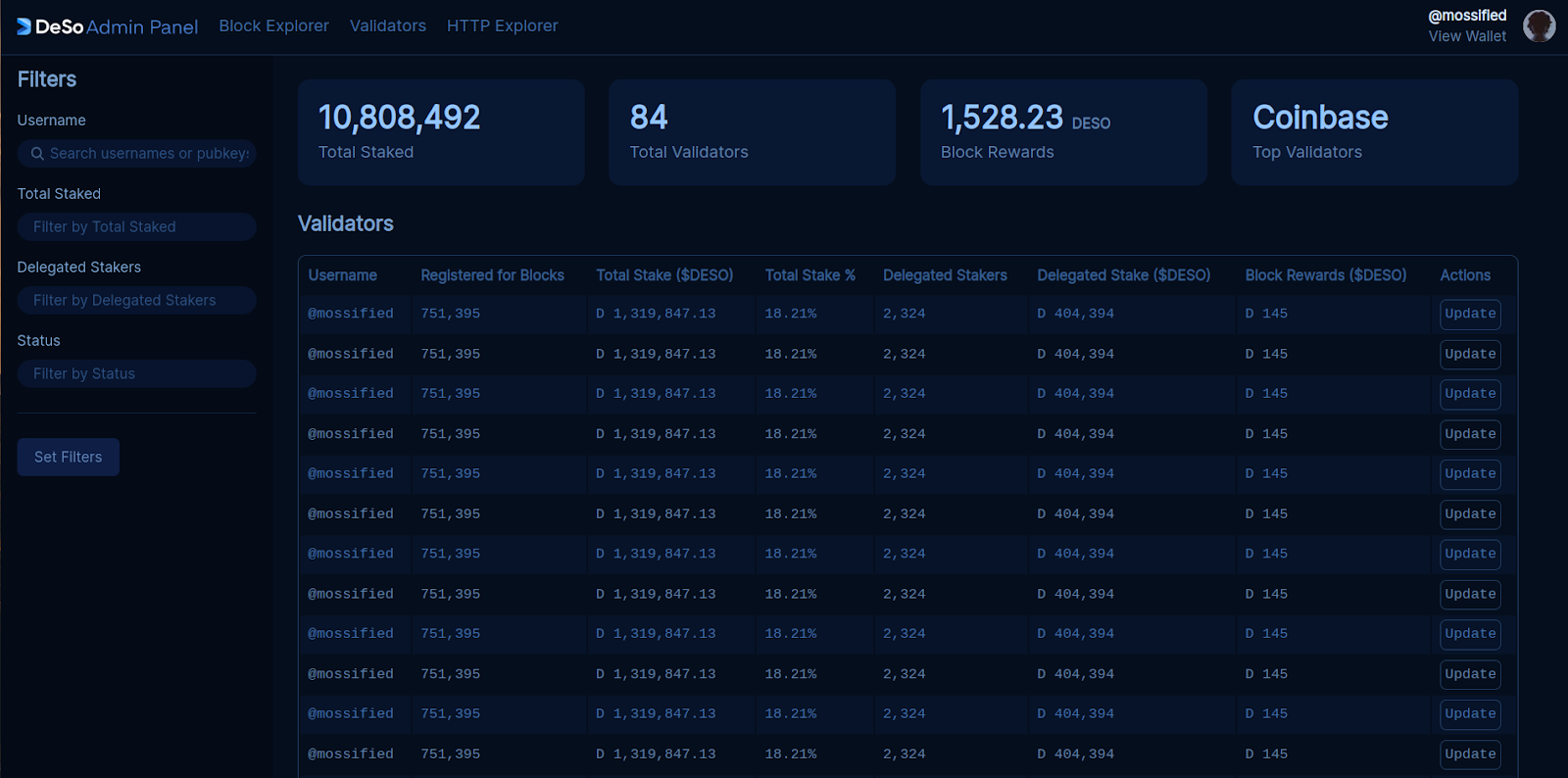

To promote decentralization of stake among validators and transparency of block rewards and fees, Revolution will have a Validator Hub application (e.g. validators.deso.com) where users can easily shop around registered validators, search and filter for certain attributes, track their accumulated block rewards, and increase or decrease their stake positions. See screenshot below.

Fast HotStuff In-Depth

Until now, we have described how a node gets in sync with the rest of the network, and how validators accumulate stake. This base level of understanding is now sufficient to start discussing what validators actually do to produce and vote on blocks, and the process by which transactions are finalized. Going forward, we will assume the reader is familiar with all of the concepts outlined in the Background section previously.

The Gist of Fast HotStuff

Looking at Chained HotStuff, the commit rule indicates that a validator will finalize block Bk-3 when it receives block Bk. However, with a slight modification, we can reduce one more round of communication, such that a validator can effectively finalize block Bk-2 when it receives Bk. Moreover, we can do this without a significant increase in complexity.

Revolution uses a version of consensus called Fast HotStuff that is very similar to Chained HotStuff, as outlined in the Background section.

The core insight that Fast HotStuff makes when compared to Chained HotStuff is the realization that there is some room for optimization with regard to how nodes timeout faulty or malicious leaders. In particular, by introducing an explicit timeout message to the original Chained HotStuff protocol, Fast HotStuff effectively makes it safe to commit one block earlier than was previously possible.

We include the full pseudocode for Revolution's implementation of Fast HotStuff in the next section, but it's valuable to consider a rough sketch of the pseudocode below, and to compare it to Chained HotStuff, which has a sketch in the Background section, and which we've also included pseudocode for in the next section:

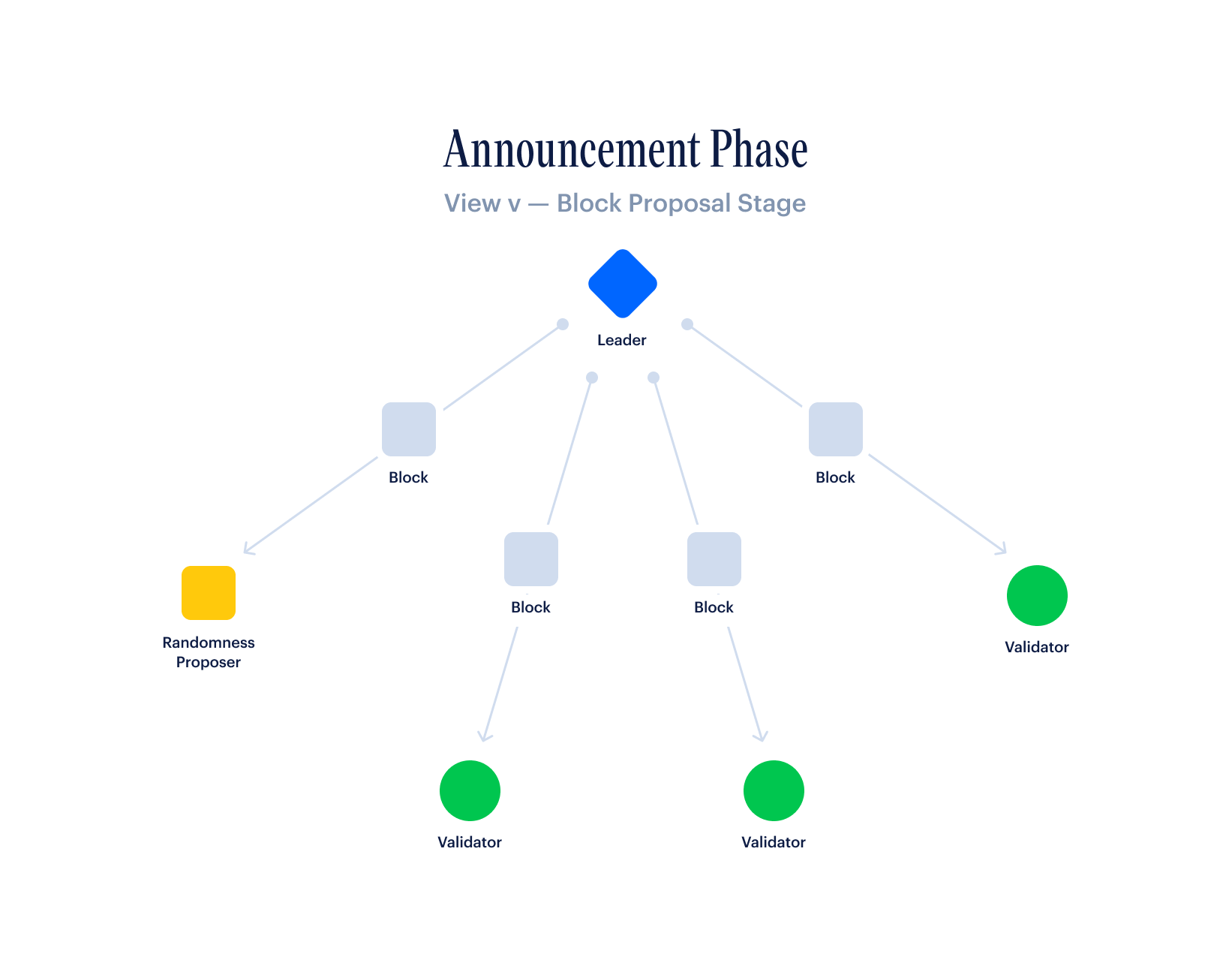

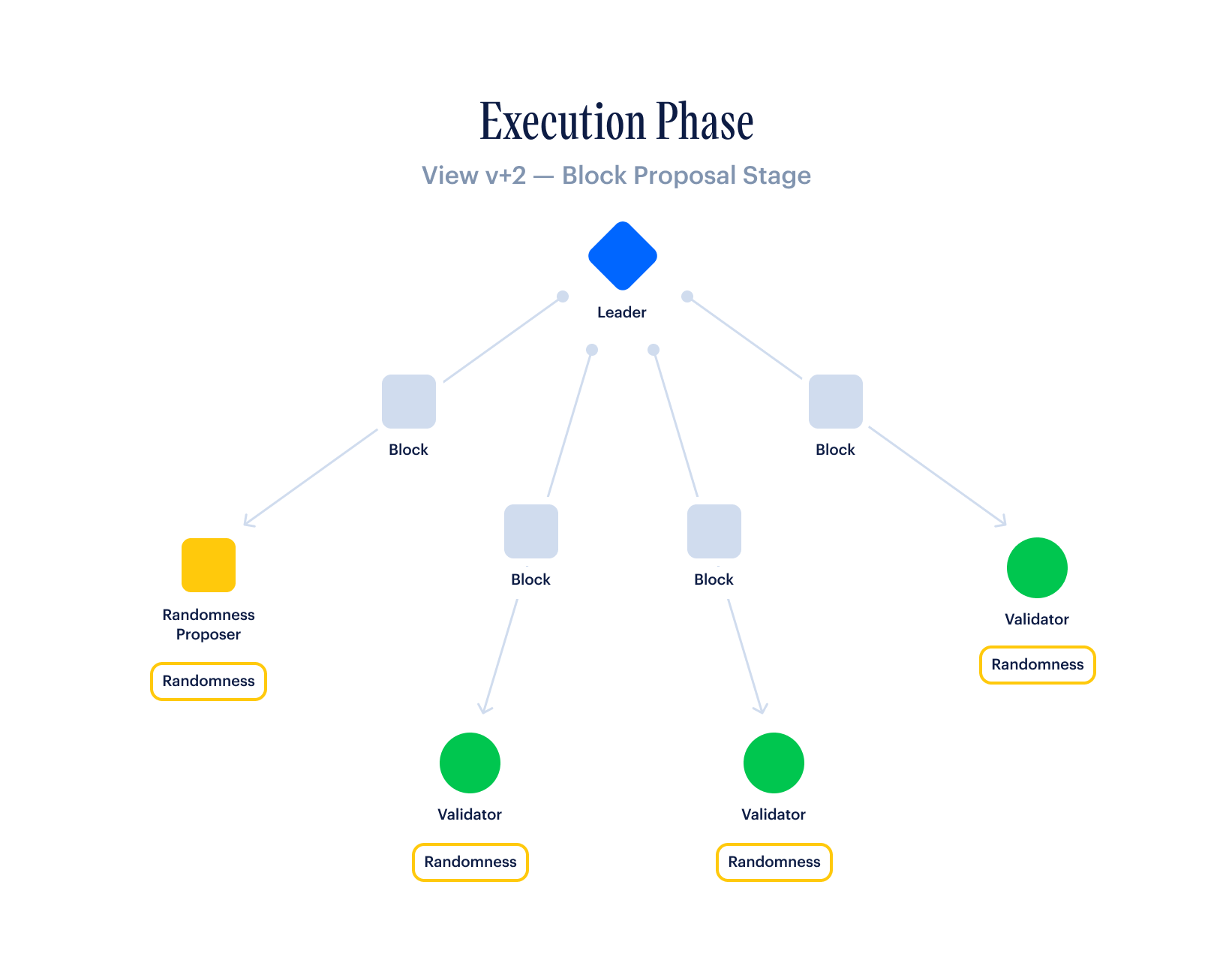

First, a leader is selected via a stake-weighted random sample of all validators. This leader bundles transactions into a block and sends this block to all other validators via a simple block-proposal message.

Then, a validator can do one of two things:

If the validator receives the block within the timeout window and the block passes their validation checks, then they send a simple vote message to the next leader, indicating that the block is valid.

However, if the validator does not receive a valid block within the timeout window or the block is invalid, then they send a distinct timeout message to the next leader.

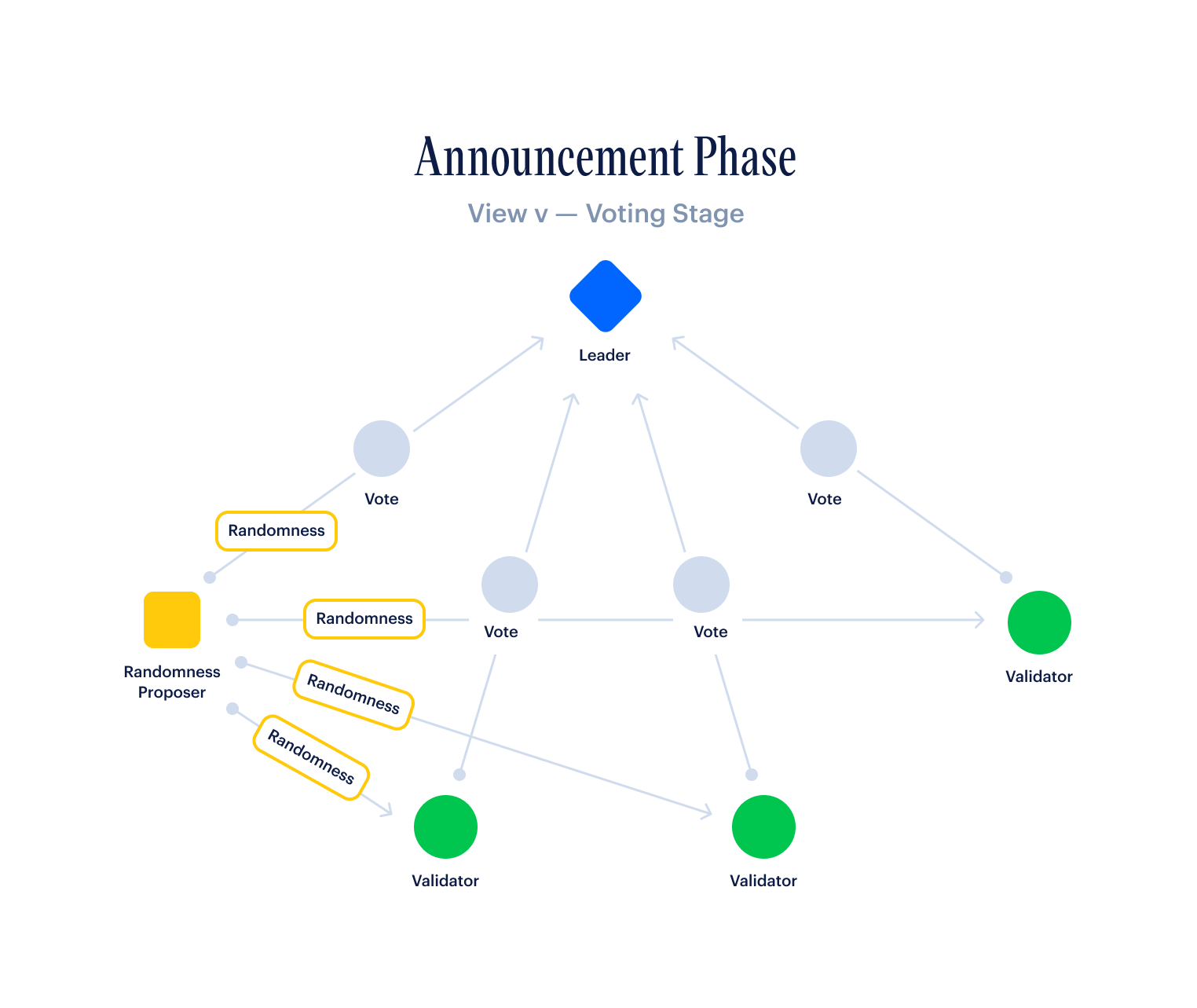

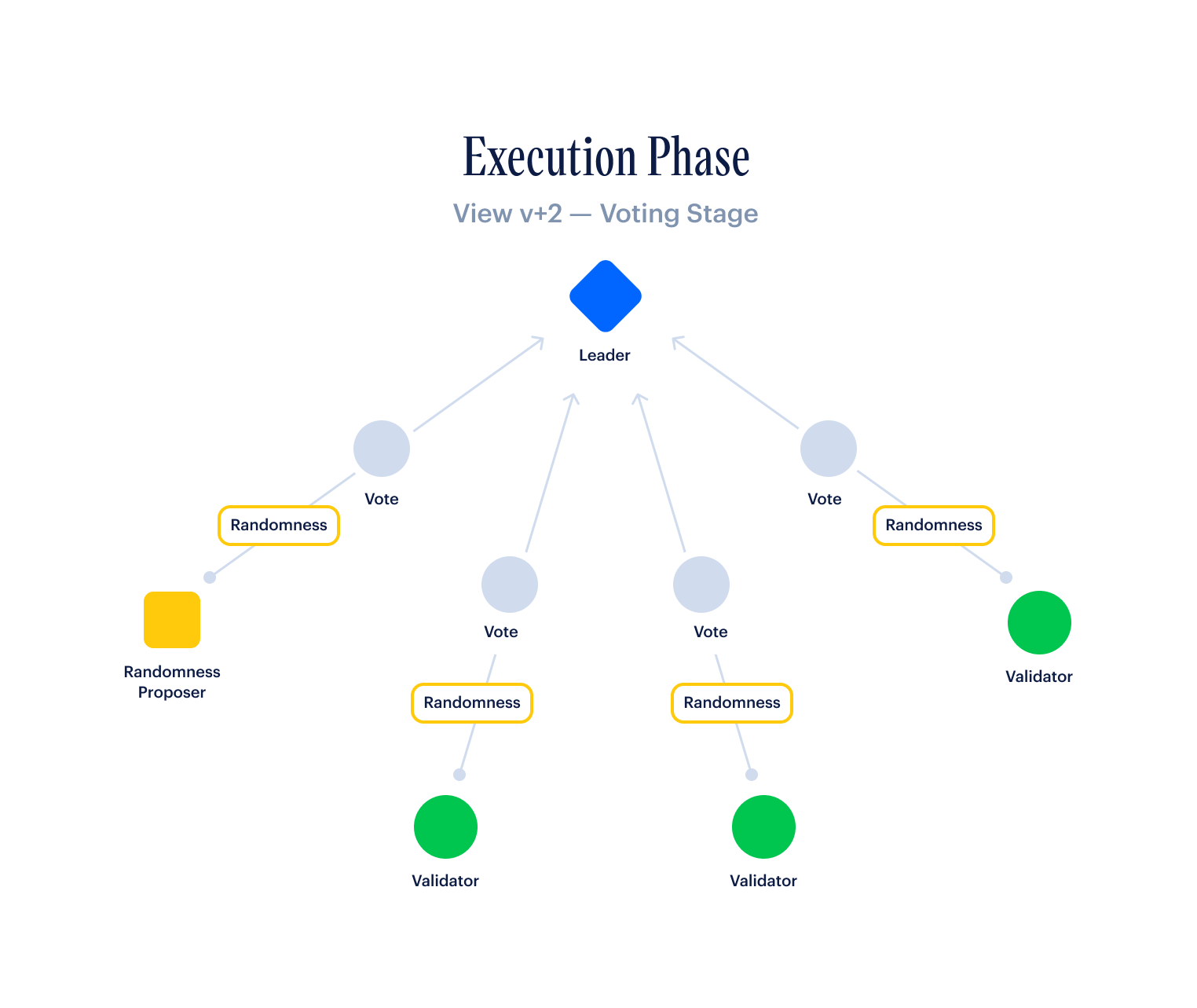

At this point, two things are happening in parallel:

- The next leader, who is ready to produce a block, is working on aggregating enough votes to make a VoteQC (2/3rds of all validators weighted by stake). If they reach this point, then they embed the VoteQC in their newly-constructed block, and broadcast this block to all validators.

- The next leader is also listening for timeout messages from all validators. If they get timeout messages from 2/3rds of all validators weighted by stake, then they use these messages to construct a TimeoutQC, which they can also embed into a newly-constructed block. In this case, their block containing the TimeoutQC will be the next block in the chain, and the faulty leader before them will be skipped.

A validator considers a block Bk-2 as finalized when it receives a VoteQC for block Bk.

This description is missing some nuance with regard to how blocks are committed and what happens during timeouts, which the pseudocode covers. Additionally, proving that this mechanism always works requires a detailed proof, which we'll refer the reader to here (original paper here). This being said, the sketch above is roughly similar to what an actual implementation would do, and it illustrates how a round of communication can be removed without significantly increasing complexity.

Fast HotStuff Pseudocode

In order to truly understand HotStuff and Fast HotStuff, including all the nuance in how vote and timeout messages are processed, we feel the best way is to browse some simplified pseudocode that we wrote for each algorithm. This pseudocode attempts to capture every edge-case in the protocol's timeout scenarios, without adding any more complexity than what is strictly necessary. You can see the full repo with all the pseudocode here. Each implementation is also linked below for convenience.

chained_hotstuff.go: This is an implementation of the basic chained hotstuff algorithm, which requires three rounds of communication in order to finalize a block. It's useful to start here in order to get a sense of what the basic algorithm looks like.

- The key thing to note about this algorithm is that it does not include information about previous timeouts in its blocks, which is the core optimization that fast-hotstuff adds, which subsequently allows fast-hotstuff to cut finalization time down to two rounds instead of three.

fast_hotstuff.go: This is an unoptimized version of the Fast HotStuff consensus algorithm. It is unoptimized in the sense that it does not aggregate signatures, which we think makes it easier to understand what information needs to be sent between validators. Notice that the code follows the high-level gist given in the previous section, but with many nuances fleshed out, such as how timeout messages are aggregated by the leader.

fast_hotstuff_bls.go: This implementation uses BLS signatures instead of vanilla signatures to optimize the previous implementation. In particular, whereas the previous implementation may end up requiring O(n^2) messages to be sent to propose a block, this implementation achieves the theoretically-optimal O(n) complexity. In addition, note that the implementation attempts to fully explain the important details of BLS via the comments so that you don't need to be familiar with BLS signatures to understand how it works (though we also include some helpful information in the next section).

We have done our best to make it so that the pseudocode can be read in one pass from top to bottom, without needing to hop around too much. We have also aimed to thoroughly annotate the pseudocode implementations with an ample quantity of comments.

If anything seems confusing, or if you have any questions, we encourage you to create an issue on the GitHub repo.

A Note on BLS Signatures

BLS signatures are used to effectively compress signatures from N different validators into a single signature value. While we won't go into too much detail on how they work here, we do want to cover some of the important properties that make them favorable in a PoS scheme like this.

Setup. BLS signatures require a "setup" phase in order to work. This amounts to adding a field to RegisterAsValidator that allows one's public key to be used as a participant in the BLS scheme.

Partial signatures. When an individual validator signs something, we refer to that in the pseudocode and more generally as a partial signature. We call it this because it can be combined with other partial signatures to form a combined signature.

Combined signatures. If you have N signatures that have all signed the same payload, i.e. if you have N partial signatures, those signatures can be compressed into a single signature that we refer to as a combined signature. The combined signature is the same size as a single partial signature. If one is familiar with elliptic curves, this amounts to adding N elliptic curve points, which is very efficient.

- There is one very important caveat, however, which is that verifying the signature requires knowing which public keys participated in the combined signature. For this reason, BLS signatures in Revolution come bundled with a bitmap that uses one bit to represent each known validator that is currently participating in consensus. The bit is 1 if the validator participated in the signature, and 0 if they did not.

- Note that this is highly-efficient because even if there are 10,000 validators included in a bitmap, this comes out to only about a kilobyte.

Verifying a signature. In order to verify a signature, the verifier must first compute the public keys of all of the participants using the bitmap mentioned previously. The verifier then adds the public keys together, which is very efficient, into a group public key. This group public key can then be used to check the aggregate signature.

Efficiency. Obviously, a BLS signature is much more space-efficient than including N distinct signatures into a message. But BLS signatures are also much more computationally efficient as well. In particular, even though a BLS signature bundles N signatures together, it is much more efficient than checking N signatures individually. This is because the act of combining public keys, as mentioned in the previous bullet, is much cheaper than the act of actually checking that a signature maps to a particular public key.

If you understand the above properties of BLS signatures, you should have everything you need to process the pseudocode for Fast HotStuff with BLS.

Line of Succession Leader Scheduling

A consensus mechanism like Fast HotStuff is typically paired with a leader selection scheme that defines which leader is going to be producing a block for each view. This is the abstracted computeLeader function in the pseudocode from the previous section.

Leader selection schemes usually utilize some form of on-chain randomness, which we will cover in the next section, to assign a particular leader to each view. This random leader schedule is computed identically across all validators, typically well in advance, so that for any given view, every validator is fully in-sync with all of its peers about who the leader is.

As a concrete example, a very simple leader selection scheme could be to use the block hash at every thousandth view as a random seed to generate an assignment of leaders to views for the next thousand blocks. For example, imaging if the leader for block N was simply:

- BLOCK_HASH(N-1) % NUM_LEADERS

There are several issues with this scheme, including the fact that the block hash is not a robust source of randomness. But hopefully it communicates the gist of how other protocols compute leader schedules.

A major problem with virtually all approaches to computing leader schedules is that the resulting leader schedule switches rapidly between leaders on every block. This constant switching has several issues, the biggest of which is that it results in a significant throughput and latency hit.

Revolution presents a breakthrough leader selection process that we call Line of Succession Leader Scheduling that drastically improves performance without compromising on censorship-resistance or decentralization. We describe this process in detail in this section.

Election and Line of Succession

Revolution introduces a novel approach for leader selection that we call Line of Succession Leader Scheduling. This leader selection approach improves network throughput and transaction finality time by designating a single node as the block proposer for a one hour term, and having them remain in their role until they finish out the term, time out, or the network revolts against them due to censorship.

The Line of Succession Leader Schedule uses a lottery of the top m validators by stake to produce a stake-weighted random ordered list of validators. Each validator appears no more than once in the list. A new list is produced once every hour, and defines the line of succession for an upcoming one-hour term.

The list of validators is used as a leader line of succession for a one-hour term. The first validator in the list is elected as the leader for that one-hour term. They remain the leader until they successfully reach the end of the term, until they time out, or the network revolts against them. In the event of a timeout or revolt, the protocol falls back to the next validator in the line of succession. The next validator becomes the new leader until they peacefully reach the end of the term, or until they too time out or are revolted against. If the protocol reaches the end of the list, it loops back to the beginning, giving everyone another chance to finish the one-hour term.

Mechanics of The Election

The protocol uses a concept of an epoch to represent each one-hour term. An epoch is defined as a range of blocks with known starting and ending block heights. The range of blocks is configured such that an epoch lasts roughly 1 hour during normal network conditions (3600 blocks). A new epoch can begin only when the 3600 blocks for the previous epoch have been finalized.

The election runs every time the protocol finalizes the last block in an epoch. The election at the end of epoch en produces the leader schedule for epoch en+2, two epochs in advance. Concretely, the election process works as follows. Assume we have four validators, with varying stake:

- Validator L1, which has 600 DESO staked

- Validator L2, which has 300 DESO staked

- Validator L3, which has 100 DESO staked

- Validator L4, which has 50 DESO staked

When finalizing the last block at the end of epoch en, the protocol takes a snapshot of the top m validators by stake. The top m validators are all eligible to be leader for epoch en+2. Assuming m=3 in this example, this means that validators L1, L2, and L3 are all eligible to be leaders in epoch en+2. Validator L4 is not eligible to be leader for epoch en+2. Note that restricting this process to the top m leaders is not strictly necessary, and that m will be fairly large in practice, e.g. 1,000.

L1, L2, and L3 are then entered into a stake weighted lottery to determine the first leader for epoch en+2 and then to determine order for the line of succession. The sum total of the stake among the top 3 validators is 1000 DESO, with L1 having 60%, L2 having 30%, and L3 having 10%. These percentages reflect each validator’s chance of being selected as the first leader in epoch en+2, and also reflect each validator’s relative stake weight amongst each other.

The protocol then uses staked weighted sampling without replacement to produce an ordered list forming the line of succession for epoch en+2. Every permutation of the L1, L2, and L3 is valid, and has a chance of occurrence in line with the probability of the occurrence of that permutation. Example:

- L1 → L2 → L3 (45% probability)

- L2 → L1 → L3 (25.71% probability)

- L1 → L3 → L2 (15% probability)

- L3 → L1 → L2 (6.67% probability)

- L2 → L3 → L1 (4.29% probability)

- L3 → L2 → L1 (3.33% probability)

This approach results in a process in which leader schedules are always known up to two epochs ahead of time (up to 2 hours). Over many epochs, this also results in leader schedules where every validator has a chance to be a leader in proportion to its relative stake.

Performance Advantages

While having a static leader and leader schedule in each epoch is a constraint, we believe that Line of Succession Leader Scheduling will result in network performance wins without compromising on censorship resistance. The line of succession mechanism in each epoch ensures that the network will always converge on the first leader that is able to propose and finalize blocks in line with the protocol’s latency, throughput, and censorship resistance requirements.

In normal network conditions, in which the current leader is able to meet the protocol’s requirements, all validator nodes can maintain direct open connections with that leader for the duration of the epoch. In contrast with other leader selection approaches that have frequent changes to the current leader, this has two advantages:

- It eliminates the need for additional network handshakes needed for validators to connect to the leader.

- It reduces the overall number of round-trip P2P messages needed to propose and vote on blocks in the steady-state.

In adverse network conditions, in which multiple leaders in an epoch are not able to meet the protocol’s requirements, this approach can reduce the total time the network spends on such leaders during that epoch. This is best demonstrated by a concrete example.

Assume we have the leader succession list L1 → L2 → L3 for an epoch. Now assume L1, and L3 are both offline, leaving L2 as the only live eligible leader for the epoch. The protocol will start with L1 as the leader. Once L1 fails to propose a block, the network transitions to L2 who can remain leader until the end of the epoch. This allows the protocol to avoid ever transitioning to L3 or back to L1, minimizing the total time spent on faulty leaders during the epoch.

In contrast, with the more traditional random leader selection schemes used by other protocols, the network would experience timeouts on 2/3rds of all views for which L1 and L3 are the randomly selected leaders.

Network Configuration

In this section, we propose initial values for the election's parameters. This being said, note that the election’s parameters are configured as global parameters for the network, which are updated via decentralized on-chain amendments. See the section on on-chain amendments for details on how these values are updated.

Eligibility for Leadership

In order for a node to be eligible to be leader for an epoch en+2, it must satisfy two requirements at the end of epoch en

- The validator node must have the minimum amount of DESO staked on themselves (100 DESO)

- The validator node must be ranked in the top 1,000 validators by stake

Epoch Duration

Epochs are tuned to a duration of about one hour during normal network conditions. Assuming the network can finalize blocks in the steady-state every 1 second, this means it will finalize roughly 3600 blocks per hour. The epoch length is initially configured to 3600 blocks to meet this.

Timeouts and Timeout Duration Exponential Backoff

A validator may time out a leader if the leader fails to propose a valid block within a reasonable amount of time. This duration is configured to 30 seconds.

The result of a revolt on a leader, which we will discuss in a later section, also matches that of a timeout. In the event of a timeout or a revolt, a validator transitions to the next leader and increases the duration with which it waits for a valid block to 60 seconds.

In the event of many consecutive timeouts or revolts with no block finalization in between, validators employ a 2x multiplier for the exponential backoff to increase the durations:

- 30 seconds → 60 seconds → 120 seconds → 240 seconds → …

The 2x multiplier ensures in the event of extended network outage, multiple node restarts, successive misbehaving leaders, etc... that the network will eventually converge on the same leader.

Solorand & Collaborand - Robust On-Chain Randomness

On-chain randomness is a critical feature of any PoS blockchain, and it refers to the concept of generating a random seed, known to all validators on the network, usually with every block, that can then be used to generate random events.

On-chain randomness is usually most useful in PoS settings for defining an un-gameable leader schedule. For example, without on-chain randomness, the leader schedule would be potentially manipulable by a single entity or group of colluding entities. But on-chain randomness can be used for many other things, including as a random seed for smart contracts that need a source of randomness in order to function.

Why On-Chain Randomness is Hard

Even though on-chain randomness is critical to every PoS scheme, it is one of the hardest things to get right. What makes it so hard? The reason is that it's very easy to accidentally introduce a flaw into a randomness scheme that allows a single entity to grind or skew the randomness significantly. To understand this, it's useful to walk through a few randomness schemes that don't work, and to understand what makes them flawed.

Strawman #1: Block hash. Imagine using the hash of each block as the protocol's source of randomness. What could go wrong with that, right? The problem is that in PoS schemes, the hash can be manipulated by the leader simply by changing the contents of the block, e.g. by reordering votes from validators.

- In particular, because votes from validators can appear in any order in the block, the leader has N! permutations of vote orderings to grind through in order to manipulate the block hash into being whatever they want. This means that, with just a little iteration through vote orderings, a leader could assure that they would be at the top of the leader schedule forever!

- Even if vote ordering is fixed, the leader can still game the randomness by omitting votes, reordering transactions, or even simply submitting a transaction of their own with a nonce that they can grind through.

Strawman #2: Pooling hashes. Imagine you want to eliminate reliance on a single validator in your randomness computation by inventing a scheme that combines randomness from N different validators. Imagine a scheme whereby all validators are allowed to submit hashes to a pool each block, and then all the hashes are combined to form a single random seed for a block (imagine the leader can't censor here). At first glance this seems more promising than the previous scheme because a single leader acting honestly ostensibly makes the seed computation random. But there is a fatal flaw with this scheme as well.

- Since PoS mechanisms operate in the open, everyone can see the random hashes that are being pooled before they are finalized into a block. Because of this, any malicious validator can grind their own randomness to skew the outcome to whatever they want.

- For example, suppose you want the pool to compute outcome X (e.g. maybe X is chosen as leader in the next block). Well, the pool's output depends on your input, since it's technically computed as Hash(poolRandomValues || yourRandomValue). Because of this, you can try all values of yourRandomValue until the overall outcome is exactly what you want.

Strawman #3: Commit reveal schemes. One way around the grinding problem, employed by RanDAO, which is utilized by Ethereum, is to implement a two-phase commit-reveal scheme. In such a scheme, each validator submits a hash of their randomness in the first phase, and then submits the actual value of their randomness in the second phase, which is checked against the hash in the first phase. The values from the second phase are then combined to create the randomness. Can you see an attack here?

- Imagine you create just ten malicious validators. Your validators submit hashes in the first phase, but selectively censor their reveals in the second phase based on what people reveal as their randomness. With just ten validators, this gives you the ability to choose from 2^10 possible outcomes to grind over for every cycle based on whether you choose to reveal in the second phase!

- RanDAO attempts to mitigate this by requiring a pledge from people who participate in the randomness scheme. This pledge is then slashed if people don't reveal in the second phase. While this may solve most of the problems in practice, it has the downside of being expensive to run (because you need to incentivize people to take the risk of losing their pledge) and still game-able if one is willing to lose a few pledges to manipulate the randomness.

Desirable Properties

Having walked through three flawed approaches, it is useful to describe what we want from our randomness scheme.

Ungrindable. This property refers to the inability of any network participant to skew the outcome of the randomness generation algorithm. With ungrindability, there is no strategy that malicious validators can exercise to influence the randomness in their favor.

Unpredictable. By this property, we mean that no validator can foresee what the randomness will look like in the future. Unpredictability does not necessarily mean that all validators will learn of the randomness at the same time – this is likely an unsolvable proposition. Instead, we only require that no validator has a significant advantage over others in predicting the outcome of the randomness algorithm.

Simple. This property consists of two parts. First, we want a construction that’s easy to reason about. Second, we don’t want the randomness computation to negatively impact the performance of our consensus algorithm. An ideal randomness generation algorithm should introduce minimal extra communication between validators.

Solorand: Simple Leader-Derived Randomness

The key thing to realize with the strawmans above is that the more choice you give in a randomness scheme, the more likely that scheme is to be gamed. This is because every choice you introduce provides a potential for grinding.

Going with this logic, the following very simple randomness scheme, which we call Solorand, works quite well, and is generally not grindable. As we will discuss, the only downside of this scheme is that it's predictable by the leader, which is undesirable, and which Collaborand fixes.

Define the randomness value computed by Solorand at block N as SOLORAND(N)

Define the designated leader at block N as LEADER(N)

Now, consider the following randomness computation for block N:

- SOLORAND(N) = HASH(SIGNATURE(LEADER(N), SOLORAND(N-1)))

With the above scheme, the randomness at block N is computed from the leader's signature of the randomness at block N-1. Because a signature of a random hash is also a random value, this gives us a way to iterate the randomness within each block in a way that does not require input from anyone. Put another way, using signatures as a source of randomness eliminates choice, which thus helps with grindability.

So, if we go with the above, what are the points of grindability?

- The leader can't grind the signature because it is deterministically computed from the previous randomness.

- Thus the only thing that a leader can do is choose to omit their value. But doing this would result in the leader timing out, and the next leader being responsible for contributing the signature, thus only affording a validator a single bit of skew each time they're the leader. Moreover, it is important to note that this skew does not compound. The skew introduced by timing out can only impact the randomness in the block directly after the leader, after which all subsequent blocks will be free of any skew due to the fact that a new leader is responsible for computing the randomness for the next block.

- But what if the leader has the good fortune of being leader multiple times before the block they want to manipulate? For example, suppose a validator is the leader for M consecutive blocks before the block they want to manipulate. How much skew does the validator get in this case? Perhaps surprisingly, Solarand still only affords this validator one bit of skew for that particular block. How is this the case?

At each block that the leader is responsible for producing, they have two choices: They can either produce the block or timeout. This results in the following set of choices, which collectively provide only a single bit of skew: